In an era increasingly dominated by technology, semiconductors have become pivotal to innovation, driving everyday devices and advanced artificial intelligence systems. The genesis of the semiconductor can be traced back to the United States in the late 1960s when American firms began to globalize their supply chains in pursuit of cost efficiencies. These tiny chips now lie at the heart of a significant geopolitical rivalry between the US and China. This contest is about technological leadership and encapsulates broader implications for economic dominance.

Global Semiconductor Landscape

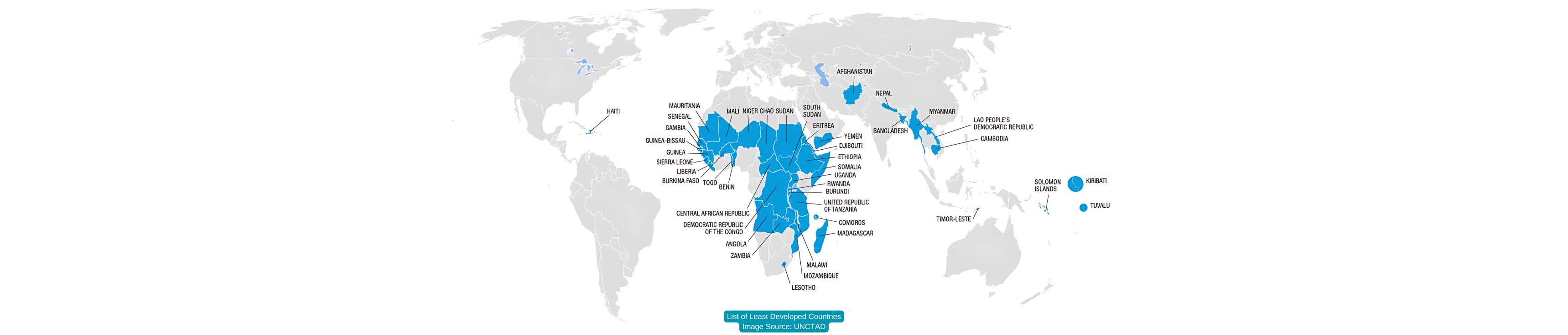

As per MarketLine, the global semiconductor market showcased a landscape where the Asia-Pacific region took the lead with an impressive $355.4 billion in sales in 2023, establishing itself as the global manufacturing powerhouse. Not far behind, the United States demonstrated its prowess with $92.3 billion, thanks to a strategic focus on high-value products and a robust intellectual property environment. The Asia-Pacific region commands the market, dwarfing the United States by more than threefold. The region has major manufacturing hubs, strong supply chain infrastructure, and significant technology investments. Though contributing less, Europe ($35.9 billion) focuses on specialized semiconductor applications, notably in the automotive and industrial sectors. The Middle East and the Rest of the World, though smaller in market size with $10.7 billion and $13.0 billion, respectively, hint at the potential for significant growth fueled by expanding digital infrastructure and technological adoption.

Source: Graph by Author using MarketLine Data

The prominence of Taiwan, controlling over 60 percent of the global semiconductor market, only heightens the strategic imperative to mitigate China’s burgeoning threats. These threats not only jeopardize American technological lifelines but also the very fabric of global tech supply chains. It's a scenario that transcends mere economic rivalry, touching the essence of national security and the quest for technological sovereignty.

US and China Semiconductor Landscape

The US semiconductor market, one of the most competitive sectors in manufacturing, thrives on the relentless pursuit of innovation. Industry giants like Intel, Qualcomm, NVIDIA, and Texas Instruments spearhead this charge, each carving out niches with their specialized technologies. Intel dominates with its comprehensive suite of processors and chipsets, Qualcomm advances with its wireless technologies, and NVIDIA leads the graphics processing unit (GPU) segment. This intense competition propels companies to invest heavily in research and development, constantly pushing the envelope with new and advanced products. These leading players dominate in terms of technology and strategic market positioning.

Moreover, Microsoft, Google, and Apple are also at the forefront of AI innovation, each making significant strides in their respective areas. Microsoft has introduced its Copilot+ feature for PCs, enhancing user productivity and experience. Google, with its Gemini AI engine, is revolutionizing the electronic device industry by integrating advance AI capabilities directly into mobile devices and computer respectively. Meanwhile, Apple has demonstrated its commitment to AI advancement through the rollout of AI features across both PCs and smartphones, as showcased in its WWDC24 event. These tech giants are not only driving the development of cutting-edge AI technologies but also setting new standards for the industry.

Conversely, while also competitive, China's semiconductor market sees a more concentrated landscape, with major players like Semiconductor Manufacturing International Corporation (SMIC) and Hua Hong Semiconductor leading the way. China's Made in China 2025' initiative underscores its ambition to self-sustain and grow its domestic semiconductor manufacturing, challenging the global dominance of US companies. Major companies, such as Semiconductor Manufacturing International Corporation (SMIC) and Huawei's HiSilicon, are playing a pivotal role in shaping the market. SMIC is a leading semiconductor foundry specializing in manufacturing integrated circuits (ICs) and providing foundry services for fabless companies. SMIC's expertise spans advanced logic process technologies, memory manufacturing, and specialty technologies for analog, mixed-signal, and RF applications, as well as automotive and IoT solutions. On the other hand, Huawei's HiSilicon focuses on designing and developing semiconductor solutions, including system on chips (SoCs) for smartphones, AI processors, networking and telecommunications chips, and consumer electronics components. Moreover, the merger between Tsinghua Unigroup and Yangtze Memory Technologies Co. (YMTC) demonstrates this trend, enhancing their capabilities and market influence.

The semiconductor market revenues projections for the United States and China could reach $77.44 billion and $198.90 billion by 2024. Hence, The United States must adopt a multifaceted strategy emphasizing innovation, domestic manufacturing, and workforce development to navigate these turbulent waters. The historic CHIPS and Science Act 2022, earmarking $280 billion for semiconductor initiatives over the next decade, is a testament to this commitment. Yet, financial injections alone won't suffice. A nurturing ecosystem for innovation, fortified by robust intellectual property protections, is crucial for fostering technological breakthroughs.

Source: Author Infographic

Furthermore, diversifying away from overreliance on foreign semiconductors necessitates a resurgence in American manufacturing capabilities. United States’ share of global chip manufacturing has dwindled to 12 percent from 37 percent in 1990. The U.S. aims to strengthen its position in the semiconductor industry with a $39 billion investment to encourage domestic manufacturing. This, in turn, demands policy frameworks that incentivize establishing and growing semiconductor facilities within the United States through tax incentives, subsidies, and other supports.

The challenge of workforce development, in particular, demands urgent attention. Oxford Economics projects by 2030, employment in the United States semiconductor industry will have grown by around one-third, adding roughly 115,000 new positions, of which 85,000 will be in technical positions, including engineers, technicians, and computer scientists. However, the industry is expected to experience a 67,100 workforce gap, emphasizing how critical it is to build a robust talent pipeline. Closing this gap is essential to maintaining innovation and manufacturing capacity, particularly in the face of competition from nearby high-tech industries.

Semiconductor businesses are already building and expanding programs to attract and skill new personnel, with 80 percent of technicians accredited in 6-24 months. A broader approach to developing the Science, Technology, Engineering, and Mathematics (STEM) pipeline is required for engineers and computer scientists, whose postsecondary education programs usually take four to 10 years. Encouraging interest in STEM fields among K–12 students and providing clear pathways to careers in the semiconductor industry are vital steps in building a robust talent pool.

In the face of China's ascendant semiconductor capabilities, the United States stands at a critical juncture. Strengthening domestic production, fostering innovation, and expanding the workforce are economic imperatives and pillars of technological sovereignty.

*Disclaimer: The views expressed in the article are personal views based on author's research and do not reflect those of the organization the author work for/represent.

Economics